SME Finance

One in four SMEs have struggled to secure funding in the past year*

Whether you're fulfilling large orders, managing input costs, or investing in production capability, when demand rises or cash flow is stretched, access to external finance is critical.

SME finance traditionally includes overdraft or business loan, designed to give established businesses the working capital and liquidity to manage high operational costs, take on larger contracts, hire staff or invest in capital equipment.

Delays and restrictions in traditional finance are driving SMEs towards alternative funding. Our recent survey shows non-bank lenders (55%) are now preferred over high street banks (45%), highlighting this shift.**

SMEs are choosing revolving working capital facilities such as Invoice Finance.

In partnership with the Strategic Banking Corporation of Ireland, we offer discounted funding and our strategic collaboration with PTSB delivers additional support to fulfil complex transactions like M&A and MBO.

Our clients rely on our experience and insight, and they know exactly who to call - real people who are invested in their success.

* / ** Findings from our SME Business Confidence Report 2025.

How can SME Finance help your business?

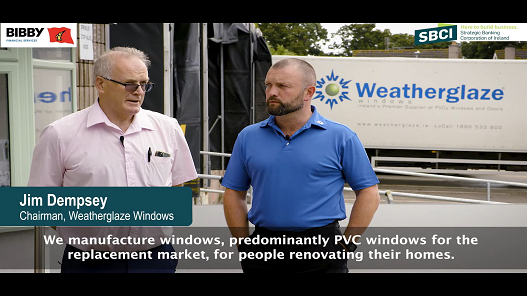

What business leaders are saying about SME Finance

Hear how it’s making a real difference for our clients

Why choose Invoice Finance?

Make your cash work smarter and start releasing funds from your invoices (sales ledger) today. Unlike traditional business loans, it doesn't require additional debt, making it a flexible way to support your business growth without compromising your future ambitions.

Is Invoice Finance right for you?

It’s suitable for you if:

- You provide goods and/or services to other businesses on credit terms of 30 to 90 days

- You have good credit management and control reporting tools

- Your business is registered in Ireland

Choosing Bibby Financial Services as your Finance Partner

- Nearly 20 years helping Irish SMEs grow with confidence

- Awarded the Financial Services Company of the Year

- As part of a global group, we’re trusted by more than 8,500 businesses around the world

- €70 million+ delivered through SBCI, backing SMEs nationwide

- Strategic partnership with PTSB, one of Ireland’s leading business banking partner

- 89% of clients rate us highly for service and support