Lower Cost SME Finance

SMEs can access low-cost, flexible finance with tailored Invoice Finance solutions enabled by our partnership with SBCI

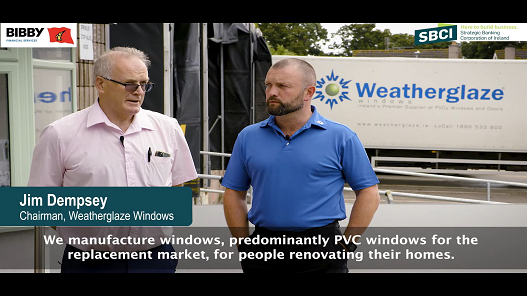

Bibby Financial Services is dedicated to powering the growing business ambitions of SMEs. Through our exclusive partnership with the Strategic Banking Corporation of Ireland (SBCI), we deliver tailored, flexible, cost-effective funding solutions that help businesses across all sectors thrive.

As the SBCI’s exclusive invoice finance liquidity partner, we’re proud to offer access to discounted Invoice Finance products, designed to unlock working capital, improve cash flow, and support sustainable growth

Latest news – €30 Million facility announced

On 18th September, we announced a new €30 million facility, bringing our total funding through SBCI to €100 million. This significant milestone reflects our continued commitment to supporting Irish businesses with the flexible funding they need to thrive.

Since 2016, our partnership with SBCI has empowered over 300 Irish businesses with more than €70 million in funding, fueling growth, resilience, and long-term success.

There’s never been a better time to explore how our SBCI-backed Invoice Finance solutions can help power your business forward.

Features

Immediate Cash Injection

Discounted Rates

Enjoy competitive pricing with up to 1.3% off our standard facility rates

Generous Funding Limits

Secure up to €5 million in funding with a minimum facility term of 24 months to qualify for SBCI’s lower rates

Eligibility

Finance both domestic and export sales under the scheme

Benefits

- Immediate Cash Injection - Get up to 90% of the outstanding value of your invoices within 24 hours of raising an invoice

- Discounted Rates - Enjoy competitive pricing with up to 1.3% off our standard facility rates

- Generous Funding Limits - Secure up to €5 million in funding with a minimum facility term of 24 months to qualify for SBCI’s lower rates

- Eligibility - Finance both domestic and export sales under the scheme

In order to be eligible for SME finance through SBCI, you need to meet the following criteria:

- Less than 250 employees

- Annual turnover of less than €50m and/or a balance sheet total less than €43m

- The enterprise is an independent, autonomous entity (or, if part of a wider group of enterprises, the entire group must qualify as an SME)

- Less than 25% of capital voting rights held by public bodies

- The company has a significant presence in Ireland