SME Confidence Tracker Q4 2025: Adapting for Growth

Access to Finance and Cashflow pressures mounting

Updated: 13 November 2025

,Mark O'Rourke

" There’s resilience and ambition across SMEs, but every gain is coming against a backdrop of high business costs, drop in profitability with margin under pressure. For business owners, ambition is not the issue, cashflow health is!"

Mark O’Rourke, Managing Director, Bibby Financial Services Ireland

Intro Summary

The SME Confidence Tracker Q4 2025 provides a comprehensive view of how Irish businesses are responding to inflation, regulatory change, and global headwinds. Drawing on the latest survey data, the report explores profitability, investment intentions, sector trends, and the impact of new policies like auto-enrolment. Discover how SMEs are adapting, where they see opportunity, and what support they need to grow their ambitions in 2026.

Top 5 Findings You Need To Read

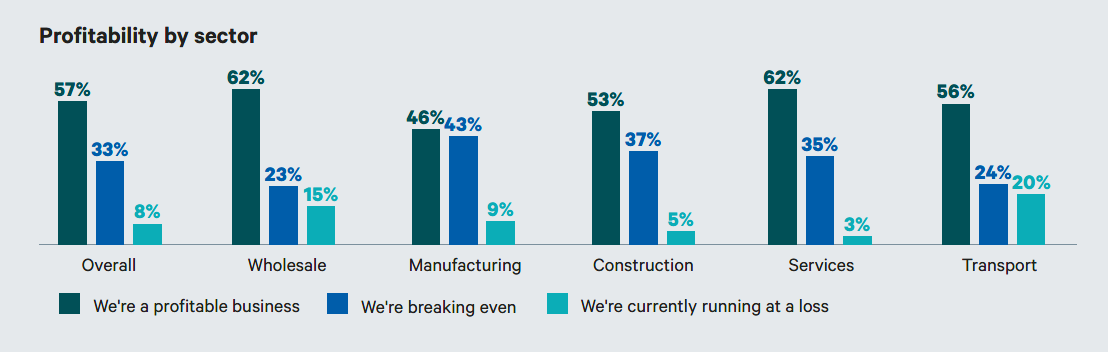

57% of SMEs are profitable, down from 64% in Q1, as cost pressures continue to squeeze margins

45% cite inflation and rising expenses as their biggest challenge, with transport, wholesale, and manufacturing most affected

91% plan to invest in the coming year, focusing on digital transformation, operational efficiency, and talent

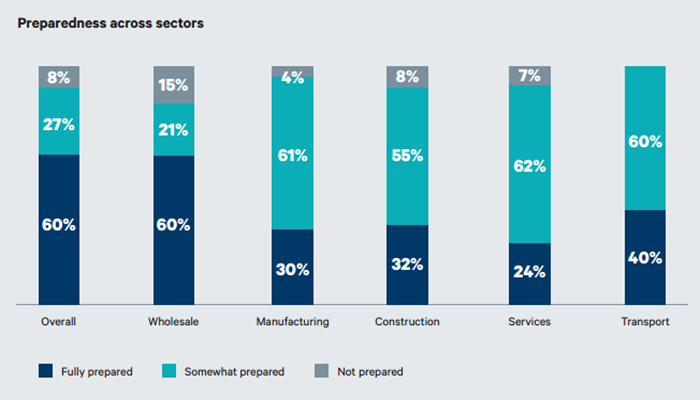

Only 27% are fully prepared for auto-enrolment pensions, with concerns about payroll costs and admin burden widespread

79% of SMEs trading internationally have been impacted by US tariffs, prompting many to seek new export markets or delay investment

Auto-Enrolment: Ready or Not?

Only 27% of SMEs are fully prepared for auto-enrolment, with readiness lowest in wholesale (21%) and services (24%). 90% of businesses are concerned about increased payroll costs and administrative burden. Many plan to absorb the cost, but a quarter will reduce benefits or delay pay increases, and 18% expect to raise prices. The transition is expected to squeeze margins and may affect hiring and investment decisions.

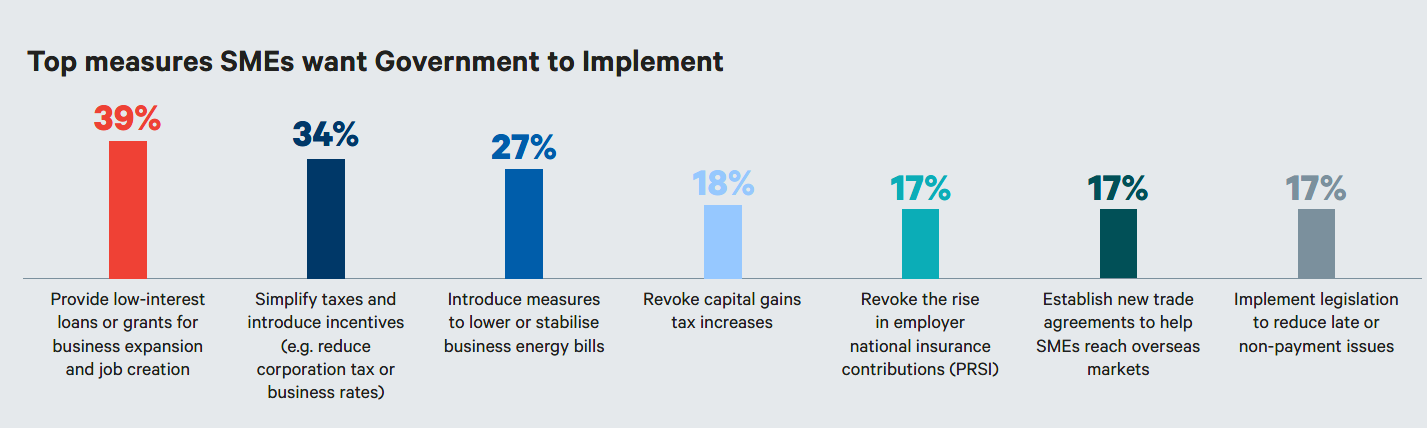

Budget 2026: Falling Short

62% of SMEs say Budget 2026 failed to address rising business costs. The top asks are low-interest loans (39%), tax simplification (34%), and energy relief (27%). Half expect to pass on higher costs to customers, and a quarter anticipate reduced profit margins or workforce cuts. Service-led and wholesale businesses feel the impact most.

Margins Under Pressure

Profitability has slipped to 57%, down from 64% in Q1, as cost pressures mount. Inflation and rising expenses are the top challenges, cited by 45% of businesses. Cashflow constraints, late payments, and bad debt are squeezing margins, especially in construction and manufacturing. SMEs with stable cashflow are much more likely to be profitable (75%).

Finance Gets Tougher

52% of SMEs report that access to finance has become more difficult, especially in manufacturing (63%) and among female-led businesses (43%). The main barriers are reluctance to take on debt (23%), high costs (19%), and lack of knowledge about options (14%). Only 62% of SMEs using external finance are profitable, compared to 54% of those not using it. Economic uncertainty and fear of rejection also hold some businesses back.

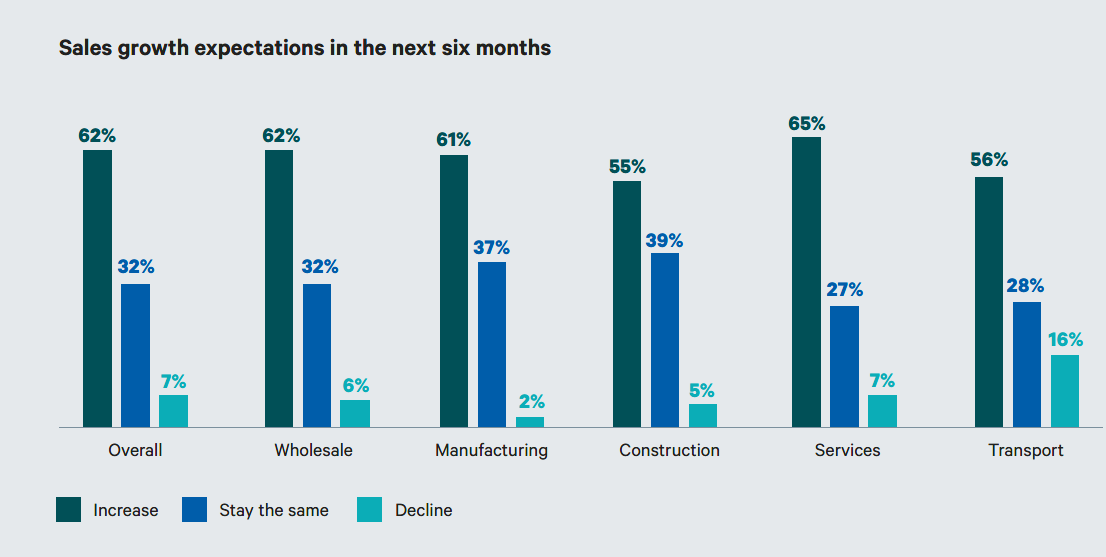

Sector Stories

Services and wholesale are the most confident about growth, with 85% optimistic about 2026. Construction faces the steepest hurdles, with access to finance (24%), late payments, and bad debt weighing heavily. Manufacturing remains steady but exposed to global volatility, while transport is investing in technology adoption (36%) to offset rising costs. Sectoral differences highlight the need for tailored support.

About the Tracker

The SME Confidence Tracker is Ireland’s leading independent survey of business sentiment, challenges, and opportunities. Now in its fourth year, it draws on responses from over 250 SME owners and decision makers across all major sectors. The Tracker provides actionable insights on profitability, investment, policy impact, and sector trends. It’s a trusted resource for business leaders, advisors, and policymakers.

Discover more of our blogs

Updated: 12 November 2025

62% of Irish SMEs say Budget 2026 fails to tackle rising costs

New research from Bibby Financial Services finds 82% of SMEs remain optimistic for 2026 despite cost challenges and tighter conditions

Read more

18 September 2025

New €30m SBCI-backed finance fund for Irish SMEs announced

The new fund brings the SBCI’s lending partnership with Bibby Financial Services to €100 million

Read more

2 July 2025

BFS Awarded Financial Services Company of the Year 2025

Bibby Financial Services Ireland has been recognised as Financial Services Company of the Year 2025 by InBusiness Recognition Awards

Read more